Significance of Preliminary Due Diligence when Buying or Selling a Business

When pursuing a potential business acquisition, a buyer should have specific criteria in mind in defining the ideal target company. Once a buyer has located the potential prospect, a low cost, high level due diligence should be performed. This initial act of uncovering information can be referred to as the preliminary due diligence process. In this stage the prospect will provide information with minimal supporting evidence as this is more of a cursory review to help evaluate whether to take the next step in the formal, more detailed due diligence process down the road.

Preliminary due diligence should occur after the buyer has determined that the targeted business meets certain characteristics. This can be accomplished during the initial search process by reviewing information from the business listing as well as from the Confidential Business Review (CBR).

The initial search process occurs prior to preliminary due diligence and should provide a high-level view of significant characteristics such as:

- Profitability: Is the prospect consistently profitable? Do the provided financials have an upward or stable trend?

- EBITDA: Is the EBITDA total sufficient. What is the EBITDA margin? Has it been consistent year over year and does the margin fall into the standard range for the industry?

- Years in Business: Is the business established or is it more of a startup? Has the company been in the business for a long period of time with proven staying power, or is it a new business trying to break into a specific niche?

- Size of the Business: Is it in the target size range? How many employees does the company have? Is it within a manageable range for the buyer to operate effectively?

- Location: Is the business in a desirable location? Is it local to the buyer or will it require a long daily commute?

- Manageable: Does the buyer have the skills to manage the business and its employees? Is the industry familiar to the buyer or will it be outside their comfort zone?

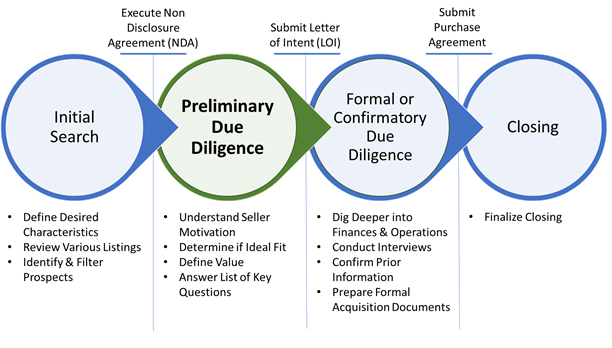

These questions will help to determine if the company is worth taking to the next step into the preliminary due diligence process. Once a target company passes the initial search test it will be time to begin the preliminary due diligence process which occurs after the confidentiality agreement is signed but prior to the signing of the Letter of Intent. The goal of preliminary due diligence is to determine early enough in the process whether there are significant red flags or issues that could jeopardize the companies value or lead to considerable problems in the future. This process should be completed before entering into the costlier and time consuming formal due diligence process.

Summary Timeline when Buying a Business:

Main Goals of the Preliminary Due Diligence Process:

1. Understand the motive behind the owner’s decision to sell.

As discussed in a previous article Determining Owner Commitment to Selling a Business, there are many reasons owners decide to sell a business, and some are more prepared than others. This preliminary process is the ideal time to try to develop a relationship with the seller if possible, to further understand their reasoning behind the sale. Uncovering their motives may help the buyer determine potential risks and even the likelihood of the sale going through.

2. Finalize the question, “is this is the company that I want to buy.”

During the preliminary due diligence process, it is important to try to poke as many holes as possible into the business with the goal of detecting issues that may lead to the elimination of the company as a serious prospect. It is important to make sure to check specific conditions here that will provide more insight before committing to the longer more extensive due diligence process.

3. Develop a fair price to offer to the seller for the company.

This initial process will help to determine the price to offer in the formal Letter of Intent (LOI). In the preliminary process, the buyer may uncover certain items that are not necessarily deal breakers but could lead to a decision to offer a lower price, such as low client mix, high competition, the potential future risk of product continuity etc.

Key Questions to Consider During the Preliminary Due Diligence Process:

When performing preliminary due diligence there are key questions the buyer should consider when determining if the business is the right fit. These are questions that can be answered without the need for supplementary financial data or a lot of extra effort. Asking the proper questions in this process is critical to the discovery process and will save time and money down the road. According to Harvard Business Review’s HBR Guide to Buying a Small Business, some key items to uncover during the preliminary due diligence process are:

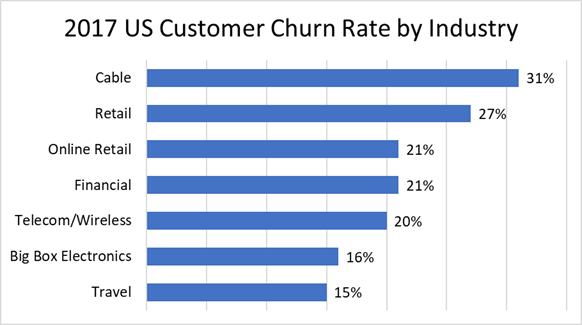

- Client Base and Customer Churn: The customer churn rate as defined by Investopedia is, “the percentage of subscribers to a service who discontinue their subscriptions to the service within a given time period.” The Customer Churn Rate can also provide additional insight into the success the company may have with client satisfaction. A high customer churn rate could be a big red flag as it can be the indication of the result of poor service, higher pricing than competitors, better system solutions by competitor’s etc.

Data from Statista (https://www.statista.com/statistics/816735/customer-churn-rate-by-industry-us/)

As a counter to the churn rate, the growth rate is the rate at which the business brings on new customers. If the company is expanding then the growth rate should be higher than the customer churn rate.

- Growth Potential: Determining company growth potential can be subjective. Initially, it is a good practice to determine the revenue growth rate which should have been completed in the initial search prior to the preliminary due diligence by comparing previous years revenue provided. However, understanding future growth can be more complicated. A seasoned company with years of history and a strong client base can be easier to predict if there are no major disruptions/changes after the acquisition, less mature company’s or startups will be more difficult. There will also be the opportunity to implement strategies through various avenues such as marketing, broadening service offering, expanding coverage etc. In many cases, companies have growth strategies in mind and have not had the time or desire to implement or execute them. A new owner with a fresh perspective may be able to capitalize on the company’s strategic plans as well as come up with ideas of their own that are specific to their experience and connections.

- Steady Cash Flows/Seasonality: It is important to understand the cash flows of the company and recognize when to expect potential fluctuations in revenue. The seasonality of a company can be predictable and varies within each industry. Common industries that are affected by seasonality are Tourism, Agriculture, Real Estate/Home Improvement, Construction, and retailers (online and brick and mortar). Companies with high seasonality may rely on certain months for the bulk of their business and must cover costs during leaner months. Companies with high seasonality may need to pre-purchase stock and inventory to gear up for busier months ahead. They may also apply cash flow strategies through short-term loans to stay afloat during the slower months. It is important when analyzing a target company’s financials to adjust or account for this seasonality. If revenues are dropping month over month during a certain time frame it may not mean the business is declining, in fact, it could be better off than it was last year at the same time. Therefore, it is important to understand the background and make the right comparisons depending on the industry.

- Customer Concentration: Customer concentration provides insight into the client mix and helps to determine if there is a healthy diversity, or if the company may be too reliant on a few clients for most of the business. At first glance, a business may appear to be showing great profit trending and steady volume only to learn that most of the business is coming from one or two customers. This can be a big red flag, particularly when entering as a new owner and relationships have not been solidified. In cases with low customer concentration, losing the main client could mean the end of the business.

- Vendor/Supplier Concentration: Like high customer concentration a high supplier concentration can also be beneficial. Businesses that rely on one or two suppliers for their key products also become dependent on these specific vendors. Successful businesses should do their best to diversify to ensure they are not at risk. Relying on a specific supplier also puts the company at the mercy of price increases that could reduce the ability to compete in that market. Diversifying vendors and having alternative options will ensure that the business can adjust quickly to change and reduce reliance on an outside service. In addition, there may be vendor relationships specific to the previous owner that may not apply to a new buyer. It is important to understand these relationships to ensure there is no jeopardy of them dissolving once the business is acquired.

- Key Employees: When acquiring a company, the buyer not only gains the business but also inherits the employees along with it. These employees can vary in their talents and skill sets and it is imperative to determine who may be an asset vs. those that may not be the right fit for the organization. To help avoid potential attrition after the purchase the buyer must act fast to assess inherited talent. According to a study by Bain & Company, of 40 recently closed mergers and acquisitions 15 deals were determined to be successful after the acquisition. Of the 15 successful deals, 90% had identified key employees and targeted them during the due diligence process or within 30 days after the announcement of the takeover. In comparison, this process was only carried out in 33% of the deals deemed unsuccessful. Identifying and retaining employees that are key to the business will help with not only a smoother transition but also can aid in the overall success of the company. This is something at a high level that can be discussed with the owner during preliminary due diligence and then more drawn out during formal due diligence and with employee interviews once the acquisition process is complete.

When buying a business, the preliminary due diligence process can prove to be a valuable, inexpensive way to uncover red flags and weed out prospects that are not in line with the buyer’s requirements. This is the time to answer key questions to help understand the reasons behind the sale, the potential value of the company and ultimately if the business will be the right fit. Once the preliminary due diligence process is complete and the buyer has a potential target they will submit the Letter of Intent (LOI) and begin the formal due diligence process. The letter of intent is a significant milestone representing the end of preliminary due diligence. Once signed the buyer is often committed to perform formal due diligence and close the deal by a determined date. Until the LOI is signed the buyer will not be protected against the seller selling to someone else. That is one reason to perform preliminary due diligence as effectively and efficiently as possible when deciding on the right business to target for purchase.