Llamas Plastics, Inc. Acquired by Lee Aerospace

Llamas Plastics, Inc., a world-class manufacturer of aircraft transparencies, has been acquired by Lee Aerospace in a transaction facilitated by Keystone Business Advisors. This acquisition will provide Lee Aerospace with direct entrance into the military aerospace transparency markets, diversify its product line, and increase its capacity.

“When evaluating Llamas Plastics, we were very impressed that they had a family-oriented culture like Lee Aerospace,” said Jim Lee, President of Lee Aerospace. We both value our employees, and many have been with us for decades. In addition, by sharing technology and best practices, we will propel both companies forward by providing additional advanced offerings to the aerospace industry; be it general aviation, commercial, or military.”

Keystone Business Advisors served as the exclusive M&A advisor to Llamas Plastics, Inc. for this transaction. “We worked closely with the team at Llamas Plastics to understand their business and goals and used our expertise and network to find the perfect buyer for them,” said Dave Richards, Managing Partner of Keystone Business Advisors.

“Llamas Plastics, Inc. is ready to move to the next level and Lee Aerospace will take it there,” said Rick Llamas, President of Llamas Plastics, Inc. “We were impressed by their people, technical expertise and plans for the future. I’m confident with Lee’s leadership, Llamas Plastics will continue to achieve great things.”

Keystone Business Advisors has completed over 250 transactions and has considerable experience in most industries including manufacturing, wholesale/distribution, service, e-commerce, software, IT, logistics, professional services and healthcare. View recent transactions here.

Read MoreStay Bonuses Will Add Value When Selling A Business

M&A Advisor Tip

Beware the Benchmark Valuation

You can practice some back of the napkin math to value a company, but it’s not always reliable. A company with $3 million in EBITDA, may, as a general rule of thumb, sell at a 4x to 6x multiple. In other words, it might sell for $12 million to $18 million in an average market.

Pulling a multiple on EBITDA is the most simplistic form of doing a valuation. But it doesn’t tell the whole story. It doesn’t account for standout business qualities that drive up value, and it doesn’t account for current market dynamics.

If you own a business, it’s a good idea to get an estimate of value every few years. Knowing what your business is worth (and what’s behind that value), can help inform your growth plans. Alternately, you may also find the business is worth more than you expected – and accelerate your exit plans.

Owners Who Engaged in No Formal Planning Prior to Engagement to Sell

Presented by IBBA & M&A Source

M&A Feature Article

Stay Bonuses Add Value When Selling a Business

We’re selling a business in which a management team member holds a minority equity stake. This critical employee stands to get a small windfall in the sale. On top of that, the seller was telling us she meant to give this employee a nice financial gift as a thank you afterwards.

That’s where we pumped the breaks a bit. We’re all for recognizing your key contributors as you exit your business, but let’s talk about structuring those payments as a stay bonus instead of an outright gift.

A stay bonus provides an incentive for an employee to stay with the company during and after a sale. They’re designed to protect the company in times of change.

Recognize that a business transition can create a lot of uncertainty and anxiety for employees. Some managers may wonder if they’ll be let go after a sale. Or, more likely in this talent market, valuable team members may feel the timing is right to pursue new opportunities—rather than put themselves through the uncomfortable process of an ownership change.

Who Gets a Stay Bonus

Typically, we see stay bonuses used in situations like these:

- An employee who must be told. Normally, we advise business owners to keep the sale process strictly confidential. If employees become aware of a pending sale, they may look for other positions rather than risk the uncertainty of a business transition. But sometimes certain team members must be included in the sale process, particularly when the owners are no longer active in day-to-day operations.

- An employee who must do extra work. Sometimes certain employees like your CFO or your HR leader will need to be told the business is for sale. They’ll be heavily involved in gathering due diligence information, which can be a big job on top of their normal duties. Unfortunately, these administrative leaders pitching in extra time are the most likely to be made redundant in a transition. A stay bonus can help ensure they stick around to help the sale go smoothly.

- An employee who’s critical to the business. Stay bonuses become increasingly important in a tight labor market. Turnover in a key position creates substantial risk for a buyer, but a stay bonus can reduce that risk and add value

to the sale process.

How They Work

Stay bonuses can be structured in any number of ways, depending on the employee’s role, compensation, and potential value to a buyer. You need to find a balance between a meaningful incentive and a gift so “life changing” that the employee is likely to walk away as soon as they get it. Between 50% to 100% of an employee’s annual salary is often a good guideline.

Payouts usually happen in two parts – a small payment (between 25% – 50%) when the sale closes and the remainder six months to a year later. Structuring these deals can be a point of negotiation with your buyer. They may be willing to share the cost of an incentive.

Similarly, some transition negotiations will include an employment agreement for key staff members. This establishes that certain severance payments are to be made if an employee is terminated after a sale. This is another way for the business owner to protect their employees and discourage management from seeking new jobs.

Timing

When do you talk to employees about a stay bonus? Telling an employee the business is for sale is always a sensitive issue, and timing will vary based on your individual scenario.

But you can’t wait too long, especially if you believe your sale could be dependent on keeping key talent in place. If you present it to the employee when the deal is still in the early stages, you can avoid last minute pressure to get contracts signed days before the closing date.

Otherwise, you may find your employee has gained an unhealthy amount of leverage. I have actually seen a key employee take a deal hostage, demanding a higher salary and bonus, because they knew the transition hinged on their retention agreement.

Talent Continuity

Buyers will pay a higher price for a business when they can eliminate perceived risks. A proven management team who will maintain key operations and relationships can help a buyer achieve performance targets.

That’s why we consistently advise sellers to develop a strong, empowered management team who can run the business. Buyers may pay a premium if they know they’ll have an experienced team to not only maintain the business but take it to the next level.

How to Sell a Manufacturing Business in California for Maximum Value

When it comes to selling a manufacturing business in California, there are many factors that can influence the value you receive. From market conditions and industry trends, to the quality of your product and your reputation in the industry, there are many factors that will impact the success of your sale. However, with the right strategy, preparation and understanding of the market, you can achieve a maximum value for your manufacturing business when you sell it.

Understanding the Market

The first step in achieving maximum value when selling a manufacturing business in California is to understand the market. This includes conducting research on industry trends, market conditions, and the competition. This research will help you to identify opportunities for growth and areas of weakness in your business, as well as help you to understand the demand for your products. This information will be essential in preparing your business for sale and will help you to make informed decisions about pricing, marketing, and negotiating the sale.

Preparing Your Business for Sale

Once you have a solid understanding of the market, the next step is to prepare your business for sale. This includes evaluating your operations, products, and services to ensure they are of the highest quality, and making any necessary improvements. It also involves cleaning up your financial records, preparing a detailed business plan, and creating an accurate representation of your business’ value. This preparation will help to attract potential buyers and increase the perceived value of your business.

Determining the Value of Your Business

The next step in achieving maximum value when selling a manufacturing business in California is to determine the value of your business. This involves considering factors such as revenue, earnings, and assets, as well as market conditions and industry trends. You may also want to consider hiring a professional appraiser, business broker or M&A advisor to help you determine the true value of your business. This will help to ensure that you receive a fair price for your business and will give you a baseline for negotiating the sale.

Marketing Your Business

Once you have prepared your business for sale and determined its value, the next step is to market your business to potential buyers. This includes creating a professional sales brochure, advertising your business, and reaching out to potential buyers. It is also important to choose the right sales approach for your business, such as listing your business for sale through a broker or selling it yourself through a direct sale. Whichever approach you choose, it is important to focus on marketing your business effectively, to reach as many potential buyers as possible.

Negotiating the Sale

Finally, the last step in achieving maximum value when selling a manufacturing business in California is to negotiate the sale. This involves working with the buyer to determine a mutually agreed-upon price, and to come to terms on the terms and conditions of the sale. It is important to have a solid understanding of the market, the value of your business, and the needs and desires of the buyer, to be able to negotiate the best possible sale. With the right approach and preparation, you can achieve maximum value when selling a manufacturing business in California.

Conclusion

Selling a manufacturing business in California is a complex process that requires careful preparation and understanding of the market. From determining the value of your business, to marketing it effectively and negotiating the sale, there are many factors that will impact the success of your sale. However, with the right strategy and preparation, you can achieve maximum value for your manufacturing business when you sell it. Whether you choose to sell your business through a broker or through a direct sale, it is important to focus on marketing your business effectively, preparing it for sale, and negotiating the best possible deal for yourself.

Read More

How M&A Will Respond to Next Recession

M&A Advisor Tip

Deal killers: The I-Don’t-Know-What’s-Next Seller

Is your identity tied up in your business? Do you know what you’ll do after selling? We look for signs that a seller is overly attached to their business. It’s a red flag, as these are the sellers most likely to dig in their heels, turn down good offers (even above benchmark), and otherwise “blow up” the deal before closing.

When it’s time to exit your business, know what’s next. You’ll have a more successful exit when you know what you’re leaving for instead of just what you’re leaving behind.

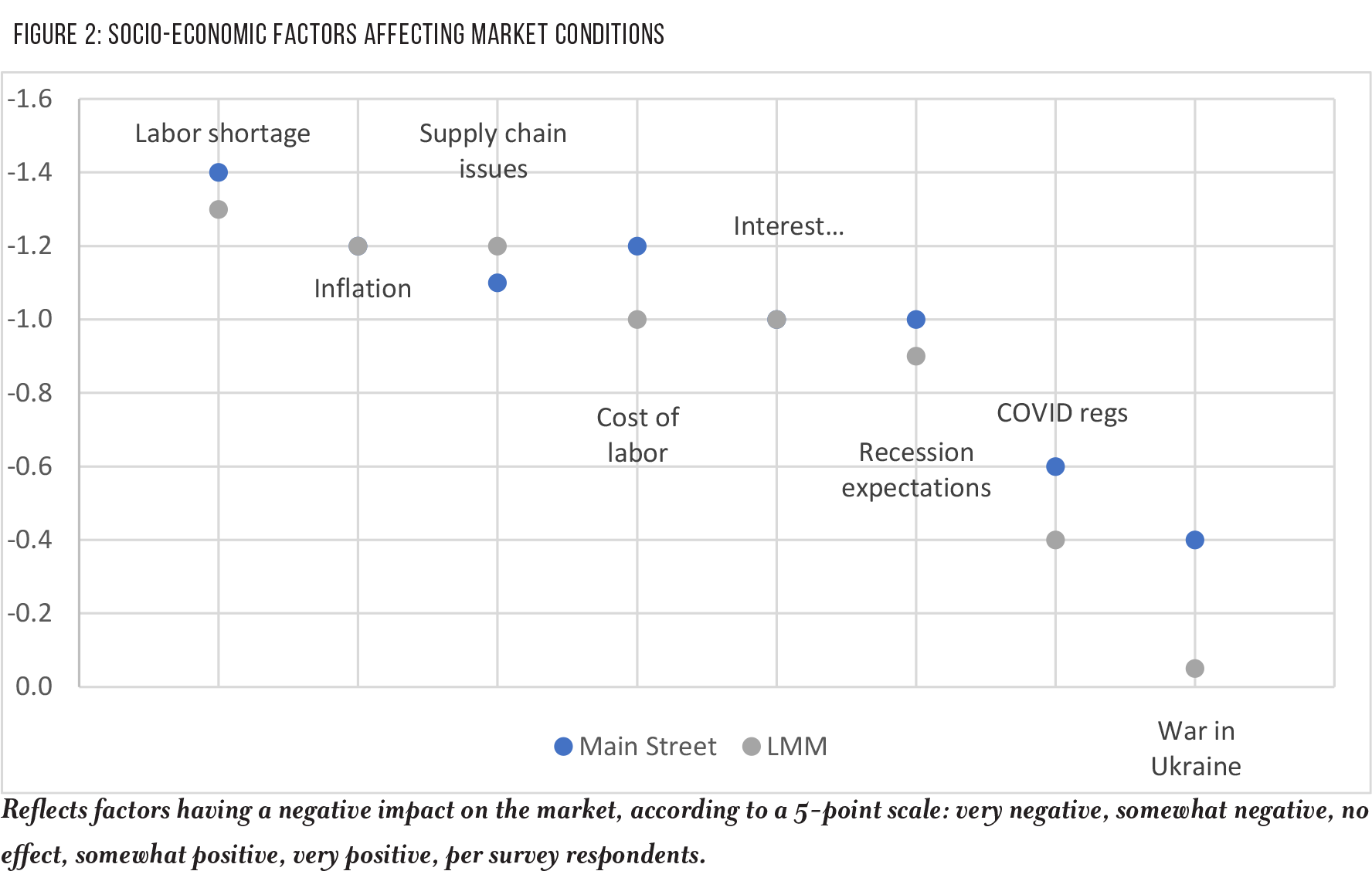

Socio-economic Factors Affecting Market Conditions

Presented by IBBA & M&A Source

Reflects factors having a negative impact on the market, according to a 5-point scale: very negative, somewhat negative, no effect, somewhat positive, very positive, per survey respondents.

Source: IBBA Q2 2022 Executive Report 3

M&A Feature Article

How M&A Will Respond To Next Recession

The M&A world isn’t quite sure what to expect in the next recession. Private equity players weren’t nearly as dominant through the last market downturns. But today those firms have $1.8 trillion in uncommitted capital they need to put to work. With money to spend, and a timeline to do it, private equity may help keep valuations high.

In 2021, for example, companies with values of $10-25 million were earning 6.1 multiples, on average, in the M&A market, according to GF Data. In 2022 year to date, those companies are getting 6.6 multiples. Those kinds of premiums – and improving valuation trends – are unexpected in times of risk and upheaval, as we have with the war in Ukraine, fuel prices, inflation, and the (potential) looming recession.

Businesses are earning the highest multiples we’ve seen in decades. If we can see that kind of activity in times of economic uncertainty, dealmakers are optimistic we won’t see a painful drop in the years ahead.

But even with nearly two trillion dollars of dry powder, private equity won’t continue business as usual. We expect to see more shifts like these in the months ahead:

Flight to quality: An investment phenomenon, “flight to quality” occurs when investors start shifting out of risky assets during financial downturns. (Have you seen the price of bitcoin lately?) And while the M&A market itself is certainly not in a downturn, we will likely see private equity be more selective – focusing on the consistent performers to the exclusion of “big opportunity” entities with unproven potential.

With a maybe-recession ahead, buyers are looking for companies with predictable performance, solid margins, and low customer concentrations. Unicorns are out.

Work horses are in. Or, to use another analogy, buyers will be looking to hit singles and doubles rather than taking the chance on a home run.

Previously, private equity was targeting minimum returns of 18%-20% for their investors. Today, many PE groups have adjusted projections down to 15%. Expectations for returns have come down in anticipation of a softening market.

The takeaway for business owners: Get back to basics. Don’t worry about hyper growth. De-risk your company as much as possible.

Market efficiency: With private equity at the table, we continue to have more buyers than desirable sellers in the market. It’s easier to buy and sell businesses right now, so timelines are shrinking.

Traditionally, it takes 9-11 months to sell a lower middle market business, but there’s a general sense of urgency and competition that’s speeding things up. For example, we’re on track to close a deal just four months after hitting the market. That kind of accelerated activity is only possible when you have multiple motivated buyers at the table.

Brands are more valuable: Private equity is looking to replicate past success. When they can find a business that fits one of their proven “been there done that” growth models, they’re willing to boost the purchase price.

The direct-to-consumer space is hot right now. If you’re a manufacturer without a branded product, you’re consistently at risk of the retailer going around you and launching their own brand. But with a branded product, people are seeking you out.

Brand recognition lowers the risk profile and increases margin. But that’s not the only reason private equity like it. Direct-to-consumer companies understand their customer better. They have a better handle on the data, including market sentiment and projections – and data-driven growth is one area in particular where private equity tends to shine.

Resiliency in M&A: The market will slow down. But good companies sell in any market. Private equity has money to deploy. Meanwhile, strategic buyers will need alternative avenues for growth as long as the tight talent market constrains organic expansion.

Things will slow down. Good companies sell in any market. Private equity has money they need to deploy, so they have to continue buying. We could see a recession in the next couple of years, but it likely won’t have as big an impact on M&A as the past.

Small Business Values Up in 2021

M&A Advisor Tip

Perks & Business Value

Business owners take a number of perks from their business, from the standards like auto expenses, memberships, and insurance plans to extras like entertainment, vacations, or an additional family member on the books.

Perks are a way for owners to be further compensated for their hard work. However, they can complicate valuing a business. When preparing your business for sale, your advisors will “normalize” your financials to account for these extras.

Be aware of providing products or services for cash – or perks that can’t be adequately tracked and proven in your books – can diminish the value of your business. When planning to sell, talk to your advisor about the tax benefits / value tradeoff of certain perks and consider where it would be better to drive cash to the bottom line.

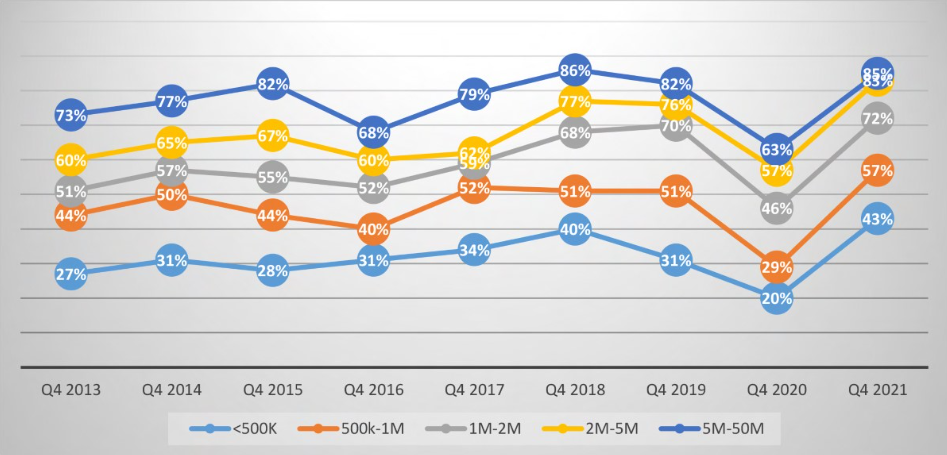

Market Pulse Survey – Quarter 4 2021

Presented by IBBA & M&A Source

Seller’s Market

A seller’s market occurs when demand exceeds supply. There are more interested, active buyers than there are quality deals on the market. In a seller’s market, buyer’s compete in order to win deals. This typically translates to increased values and more favorable deal terms for the seller.

In Q4 2021, seller market sentiment rebounded, setting a new peak in all but the $5M-$50M sector.

“Business confidence and competition is high. It’s amazing how fast we rebounded to record levels,” said Dave Richards, President of Keystone Business Advisors. “This is the strongest upward swing we’ve seen in any 12-month period.”

Source: Seller Market Sentiment, 2013-2021 Q4

M&A Feature Article

Small Business Values up in 2021

Business values increased in 2021, despite ongoing challenges from the pandemic, talent shortages, and supply chain disruption. Deal activity continued at an intense pace, with advisors across the country reporting increases in both incoming deal flow and completed engagements.

More advisors characterized this as a seller’s market than nearly any other time in the last decade, according to the year-end Market Pulse report from IBBA and the M&A Source. Buyer confidence is high, as is competition for quality deals.

Businesses with enterprise value of $5 million to $50 million earned an average multiple of 6.0x EBITDA (a survey peak), realizing an average final sale price at 113% of the internal target benchmark. Multiples remained at or near market peak throughout the Main Street and lower middle market.

Meanwhile, time to close shrank in nearly all market segments. Time to close was likely facilitated by the high rate of buyer competition as well as a push to get deals closed before year-end. Here at Keystone, we closed 40% of our transactions in the fourth quarter, and we’ve heard that trend was fairly consistent across the industry.

The year end is always a hot time to get deals done as buyers and sellers push to meet self-imposed deadlines. We also know a number of sellers entered the market in early 2021, planning to get ahead of potential increases in capital gains taxes. Many of those deals would have had accepted offers and been in due diligence by the time it became clear tax changes were not yet coming.

Main Street Activity

In the Main Street market last year, individual buyers accounted for 71% of business transitions. Of those, 40% were first time buyers and 31% were repeat business owners or what we call “serial entrepreneurs.”

Another 26% of Main Street buyers were existing companies. These are the strategic buyers acquiring other businesses as a way to expand or eliminate competition. A small percentage, just 3%, were private equity acquisitions.

While market definitions vary, businesses are generally considered “Main Street” if they have an enterprise value of less than $2 million. The majority of the transactions that happen in this sector are small, less than $500,000.

In 2021, the most active industries trading hands in the Main Street market were personal services (15%), construction (12%), business services (12%), consumer goods/retail (12%), and restaurants (11%). This represents a small drop-in restaurant activity, likely due to ongoing fallout from the pandemic.

Of those Main Street sellers who went to market in 2021, 53% were preparing for retirement. Another 11% were selling as part of a recapitalization. In a recap, the seller (or sometimes their management team) keeps some level of equity stake in the business while a buyer infuses new capital for growth. Other reasons Main Street sellers went to market included burnout, health issues, relocation, and family issues.

Lower Middle Market Activity

In the lower middle market, where businesses are valued between $2 million and $50 million, the buyer pool shifts. Here individuals accounted for a third (34%) of buyers in 2021, relatively on trend with past years.

The number of individuals buying businesses in 2021 is notable given the highly competitive talent market. It’s likely these buyers (and Main Street buyers, too) could have their choice of employment opportunities. And yet there remains a definite draw to being a business owner. People still want to build something of their own and control their own destiny, even in a job seeker’s market.

Existing companies accounted for 40% of lower middle market transitions in 2021. Generally, these companies have strong balance sheets and are looking to acquisition as a way to grow at a time when organic growth is difficult due to talent shortages.

Private equity continues to remain active in the lower middle market, accounting for 24% of all business transitions. Private equity buyers generate financial returns by acquiring businesses. They typically plan to hold a business for 5 to 7 years, often acquiring similar types of businesses to bolt on, before reselling a larger, more lucrative operation.

These financial buyers tend to focus their efforts on middle market opportunities of $50 million or more. But with competition for those larger deals running hot, we see many firms ticking their attention down to the lower middle market. Here it’s possible to find deals that are large enough to make a difference in their portfolio and yet small enough to go unnoticed by some of their competitors.