30 Second M&A Update – The happiest business owners know what’s next

Time Kills All Deals

More than purchase price or structure, time is the most likely reason a business sale will fail. Time breeds frustration and fatigue. From irascible attorneys to disorganized brokers and licensing issues, plenty of factors can bog down a deal.

Sooner or later one party or the other gets fed up and rationalizes, “It wasn’t meant to be.”

Your advisor should have a reasonable client load (no more than four or five is ideal) so they can give you the time and energy you deserve. Look for an office with a manager dedicated to closing details. You need someone organized and proactive, looking several weeks and months in advance.

Market Pulse Survey – Quarter 2, 2021

Presented by IBBA & M&A Source

M&A Feature Article

The happiest business owners know what’s next

I had the privilege of chatting with Bo Burlingham, former executive editor for Inc. magazine and author of several books, including Finish Big: How Great Entrepreneurs Exit Their Companies on Top.

We talked about one of the key discoveries that led to the book, namely that so many business owners were unhappy after selling their companies. It didn’t really matter how much someone got for their business – some sellers were delighted while others were depressed and miserable.

What made sellers unhappy? Burlingham spent years doing interviews to find that out. And one of the biggest issues he found is that people didn’t have a place to redirect their passion and energy.

For many entrepreneurs, the business becomes their identity. It gives them direction. Without that outlet, some former business owners become unmoored. Suddenly, their phone isn’t ringing as much. No one needs them to make hard decisions anymore, and that can be troubling for some folks.

Burlington describes these owners as “wandering the desert.” They’re searching for that new thing to get excited about, and some of them take years to find it.

You might think a little wandering sounds fine, but retiree beware! There’s actually research that shows early retirement can increase your chance of early death.

A 2019 study conducted by economists at Harvard and State University of New York found that cognitive decline accelerated when people left work. Researchers contributed it to the loss of social engagement and connection that many people find in the workplace.

And yet business owners should not delay selling. Ironically, the best time to sell is when you’re engaged and excited about your business.

Buyers pay for the future cash flow of the business, and that means you’ll get the most value when you go out on the upswing. Buyers feed off your energy, so you want to show them someone who’s really truly passionate about where their company can go.

But the kicker is, you need to be passionate about your next steps, too. It’s important to know what you’re headed for, not just what you’re leaving behind.

When an entrepreneur’s identity is wholly tied up in their business, that can be a red flag. It’s a sign they might hold on to the business too long, past the point where their leadership is the best thing for the company and its value.

That’s why we ask sellers to go through a “bucket list” exercise. Think about what you want to be remembered for. What captures your interest and enthusiasm, besides your business?

Selling your business should be the first step in your best chapter ever. You’ll have the gift of time and money – and the opportunity to do anything with it you want. The best thing for your health, your happiness, and the value of your company is to know the next chapter you want to write.

About Us:

Keystone Business Advisors is a full-service mergers and acquisitions advisory firm and leading business brokers in Los Angeles. We specialize in managing the sale of privately-owned California-based businesses with annual revenues up to $100 million. Contact us if you are searching for Business Brokers in Los Angeles, Ventura County Business Brokers, or Business Brokers in Southern California.

5 Ways To Prepare To Sell Your Business

Preparing To Sell Your Business

Preparing to sell your business can be something you do in a month, or an exit plan can be built into your company from the very start. How to prepare to sell my business is just one of many frequently asked questions we receive. No matter if you are just starting to contemplate the sale of your business or if this has been your desire for a long time, there are a few ways to prepare yourself to sell your business.

1. Prepare Yourself Emotionally To Sell Your Business

A lot of business owners are surprised when they feel emotional about selling their business. Having operated their business logically and knowing it was time for them to leave and retire, it can come as a surprise the amount of emotion behind selling your business. Hiring a business broker to sell your company can help manage the emotions of selling a business. A broker can help manage negotiations as well as the marketing aspects of selling your business. This can remove you and the emotions involved in selling your business.

2. Train Your Employees

If you are planning on selling your business, your employees must be prepared to operate your company without you there. If you have ever gone on vacation and returned after a week or two, you can quickly see the weak areas of your business operations that need to be attended to. Making sure your employees are trained and have the support they need without you there is vital to the survival of your business after you sell it.

3. Get Your Company’s Financial Information Together

Take time to get all of your company’s financial information together and organized. When you are preparing to sell your business, having access to past financial records and information is important for two reasons.

- Financial Transparency: Having financial transparency with a potential buyer will make them more interested in buying your company because they will have a better understanding of your company’s value

- Your Business’s Value: In order to determine your business’s value access to the past 3 years of taxes is needed. This will not only help you display your gross profit but expenses as well as your investments.

4. Get A Business Valuation

One of the first steps to selling your business is getting a business valuation. In order to sell your company, you need to know how much it is worth. At Keystone Business Advisors we will work with you to determine the value of your business and then we will help market your business with that listing price.

5. Increase The Value Of Your Business

If you are planning on selling your company, it is a great idea to take measures to increase the value of your business. Many businesses that are investing in their own growth are already increasing their business’s value, but it is always a great idea to reflect on what your company can do better. Doing this will improve the quality of the business you sell and increase the business’s listing price.

Contact Keystone Business Advisors To Sell Your Business

Learn more about preparing your business to sell and contact Keystone Business Advisors to help you sell your business. Selling your business through us requires no money upfront since there is no fee until your business is sold. Our unique approach is focused on quality business that we sell to qualified buyers. Contact us today.

Read MoreDifference between real risk and perceived risk and its effect on the price of a business

In a previous blog, we discussed briefly how risk can be shifted between the buyer and seller during negotiations to achieve the desired price. Visualize with me for a moment; every deal has a big bucket of risk and each deal has a different size bucket. That bucket is filled with perceived risk and real risk. At the closing table, the risk is going to be poured out between the buyer and seller. A deal where no risk is poured in the seller’s cup would be an all cash deal. A good example of a deal where very little risk is taken by the buyer might be one that includes a small down payment and the rest being paid out over 10 years. These examples would indicate prices that reach into the far ends of the spectrum.

An all cash offer is the least risky offer to a seller, but the most risky offer to the buyer. As price gets higher a buyer will typically lengthen the time to pay the seller, or make the price contingent on the performance of the business. Keeping the seller involved is another way to lower the risk. The basic rule of thumb is (more…)

Read MoreHow Our Approach Differs

1. Selective

There are several reasons why a business owner has an interest in selling their business. We have found it important to work with those clients who are truly motivated to sell their business rather than follow the philosophy “anything is for sell at the right price”. Unfortunately, the right price is often not one which is in line with the market. We are not adding value for our clients or ourselves by marketing a company that is priced well above the market. We do company and industry research, provide an opinion of value for all our clients and have a good understanding of what the market will bear. We are also selective in the sense that if we believe a business is not prepared to go to market in the near term or there is not enough earnings being generated, we will make recommendations for areas of improvement to better prepare the company for sale in the future as well as make introductions to key resources which can help improve business performance.

2. Comprehensive Marketing Program

The KeyStone marketing program is designed to reach the maximum number of potential buyers without compromising your identity.

Confidential Business Review. The marketing program starts us creating an in-depth 10 to 20 page Confidential Business Review (CBR) which is the marketing package we present to prospective buyers after they have been pre-qualified. The CBR provides a thorough overview of the key aspects of your business including; description of the business and the industry it serves, history of your business, description of product and/or services, operational overview, roles and responsibilities of the management team and/or key employees, customer and market overview, summary of financial information and sustainability of earnings. We have found that you only have one time to make a first impression, and an effective marketing package will help do just that.

Maximize Market Exposure. A key value we have been able to add for our clients is our ability to market your business to a broad spectrum of buyers, confidentially. Quite simply, the wider the net, the bigger the fish we can catch. We typically take recommend the following three prong approach for most of our clients which include:

Confidential Online Advertising. We are not unique in marketing your business online as this is a common industry practice. However, we do have strict internet marketing standards which include the following:

-

- All online advertising is discrete and to maintain confidentiality.

- All marketing copy is tailored for your specific business/industry.

- We pay for premium posting placement to help your business stand out from the rest.

- We advertise on up to 10 different websites depending on the size and type of your business. Sites may differ depending is buyer is a financial, strategic or private equity buyer.

Broad Buyer Database. We have developed a database of thousands of buyers which we categorize by industry and size of business. It is not uncommon for us to introduce your business to someone we have meet with or spoken with over the past 10 years. We have developed relationships with financial, strategic, private equity groups and search funds, all of which we maintain in our proprietary database.

Strategic Buyer Search. One of our key differentiators is that we actively target strategic buyers and not just rely on internet advertising. Our strategic buyer search is tailored for your specific business depending on the type, size and other circumstances for your business. We utilize a third party database which provides us access important information such as annual gross sales, number of employees, contact information for the business owner, all of which we can search by industry segment. We often start by sending prospective buyers a letter which provides a high level overview teaser of your business and follow up with a call directly to the business owner or sometimes the business development representative for our targeted acquisition candidates.

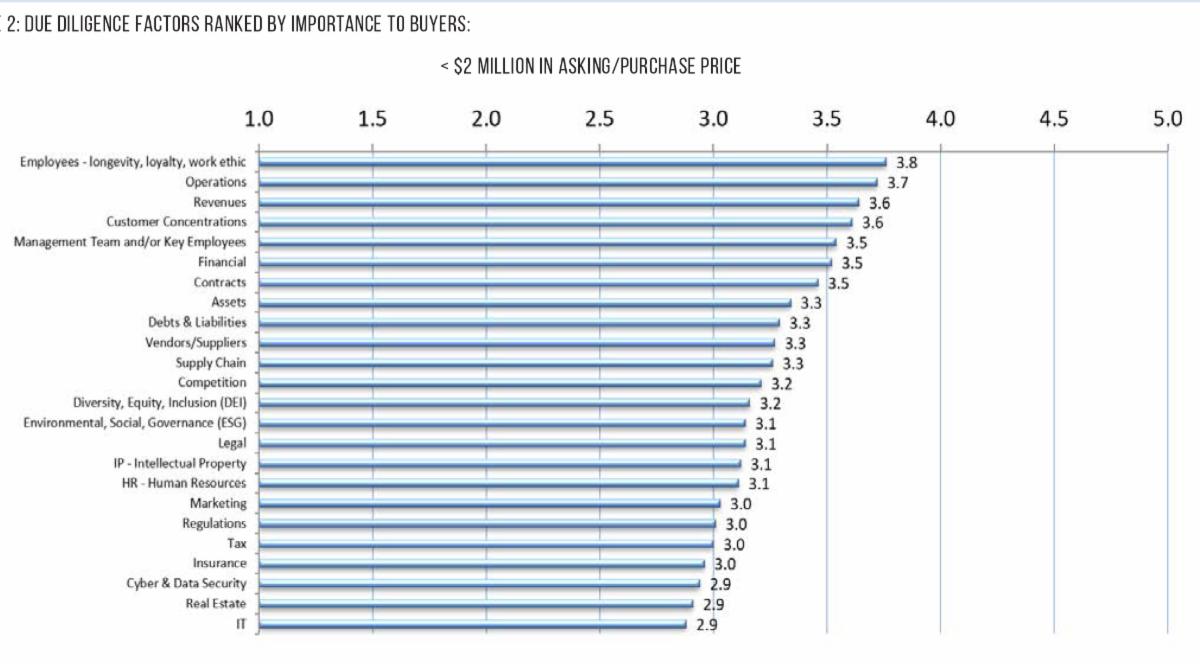

3. Upfront Due Diligence

When keystone was founded in 2004, it was built based on the philosophy that the extra time we spend on the front end to ensure that our clients business is presented honestly and in the best possible manner will ensure a smoother transition process and yield better results for all on the back end. This requires that we conduct upfront interviews with you to better understand your business, its key value drivers as well as its challenges. We conduct industry research and provide an opinion of value report for all our clients to ensure that the business is not over or underpriced. We work with you and/or your advisors to recast the last three years of financial statements to account for all discretionary expenses which could add profit to the bottom line which results in a greater value for your business.

4. Hands On Approach

Starting with our initial face to face meeting, through presale planning, valuation and pricing, creation of marketing package and program, buyer qualification, offer preparation and negotiation, due diligence, transition planning and post-closing follow up, KeyStone offers a hands on approach to keep things moving forward in an orderly manner to ensure that sensitive information is protected, uncertainty is avoided and the best price is achieved.

Read MoreWhat Key Aspects Should a Buyer Evaluate When Acquiring a Business?

I have worked with well over 1,000 prospective buyers looking to purchase a business over the past 15 years and I would estimate that probably 80% to 90% do not have a particular business category in mind. I can also say that may who have called my office inquiring about a specific business often end up buying something very different from what they had initially called on. A common question I get is what is a good business to buy? While I do have preferences for specific types of businesses, the better question is what are the key aspects I should evaluate in determining which business to buy? Here would be my top 5 factors a buyer should evaluate to narrow down the options and help determine which business is the best fit for them.

Do I have any related experience I can leverage into this business?

When the economy went south in late 2008, many buyers who had used SBA loans to purchase a business had defaulted on their loans. The SBA evaluated this and determined that one of the key factors why new business owners were not able to successfully operate their business during these difficult times was due to (more…)

Read More