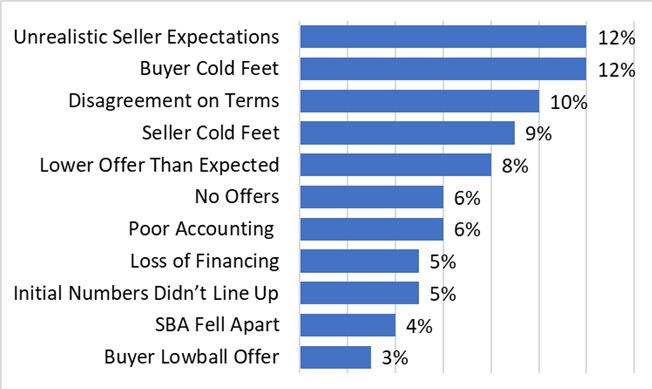

Top Reasons Business Sales Transactions Fall Through

Often with a small to midsize company the owner has put a great deal of time and energy into the success of the business. The owners may see the company as an extension of themselves that they worked hard to build and as a result may be looking at it from an emotional or egotistical perspective. Some owners may know the ins and outs of the business like the back of their hand but may not take the time to evaluate how the business may look to a potential buyer. This lack of awareness and preparation can lead to potential reasons for termination of the sale including poor accounting and bookkeeping, inaccurate sales or performance data, unrealistic valuation, or longer than expected transition times to name a few.

According to a sample polling of IBBA business advisors the top reason that half of the deals fell through in Q1/2018 was unrealistic seller expectations at 12% (tied with buyer cold feet). When valuing the business prior to sale it is not surprising that many owners will have a higher than expected price in mind. This is reasonable knowing how much effort has been put into to getting the company where it is today. Owners will also have strong emotional ties with the business that simply are not quantifiable. This perspective can further be explained by what is called the endowment effect. Simply put the endowment effect is the tendency for people who own a good, or business in this case, to value it more than people who do not. The endowment effect causes many sellers to have an inflated idea of the sales price due to their unique perspective. Buyers on the other hand are looking more at the bottom line and are concerned with cash flow and potential risks. A buyer is usually concerned with specific questions such as:

- Does the business have recurring customers?

- What is the customer churn rate?

- What is the growth potential and earnings forecast and does this growth come from the right places?

- Are the cash flows steady or more seasonal?

- What is the owner’s relationship with the clients and vendors?

- Are these relationships specific to the owner and could that change with a new one?

These are all questions the seller should be prepared to answer that could affect the value and business terms that the owner did not account for.

Some additional reasons for owners to back out of a deal as outlined in the Harvard Business Review Guide to Buying a Small Business are:

After tax cash flow: The money the owner receives after tax implications is lower than expected

Continuing involvement: The required transition process and time to prepare the new owner is more complicated and time consuming than expected

Misunderstanding of Sales Process: Owners are not aware of certain standard practices such as requirement of working capital.

Extensive Due Diligence Process: Due diligence can take longer than expected and require more information than owner was willing to divulge.

Top Reasons Business Sales Transactions Fall Through from IBBA Q1/2018 Market Pulse

While about half of all businesses terminated prior to closing in Q1/2018 there are ways to evaluate the owner’s potential commitment to sale and help to improve this statistic. Many fallouts occur due to the owner’s inability to prepare the business for sale and understand the process involved in the deal. Proper planning and a well thought out exit strategy can not only help to answer the question of “how to sell my business” but will also help to set realistic expectations and ensure the highest value is obtained when the owner is ready to sell. Sellers who properly plan ahead will avoid many of the common pitfalls listed above that could eventually cause the deal to fall through.